The Brexit storm

How procurement and supply chain professionals are tackling the issues.

CIPS members can record one CPD hour for reading a CIPS Knowledge download that displays a CIPS CPD icon.

Dr John Glen, CIPS Economist and Director for Centre for Customised Executive Development at Cranfield University

The UK election has reduced the probability of a hard Brexit, which is causing the UK economy to grow at a faster rate both before and after Brexit. It was assumed that, armed with a larger majority, the UK would be able to negotiate a Brexit deal which would allow preferential access to EU markets with a tariff below current World Trade Organisation (WTO) levels and/or no tariffs. The first survey ended before the election, and the position has dipped further.

This line of reasoning would justify the appreciation in sterling against both the US dollar and the euro that occurred immediately after the announcement of the election. There is an expectation that the Prime Minister would deliver an economic policy based on less austerity than the Cameron Government, elected in 2015. Her fiscal policy would be more expansive and, therefore, supportive of higher levels of economic growth. This approach to economic policy would be a continuation of the policy stance taken by Chancellor Philip Hammond in his autumn statement and this year’s budget statement.

While it may be the case that an enhanced majority for Theresa May would improve her negotiating position, one might argue that the probability of a hard Brexit has not been reduced.

Since the extent of Theresa May’s resolve in the Brexit negotiations – as measured by the size of her Westminster majority – is unlikely to overcome the EU insistence that if the UK wishes to have preferential access to the EU market post-Brexit, the UK will have to accept freedom of movement of people. If the UK refuses to concede on this point then it is difficult to see how a hard Brexit can be avoided.

The lack of any strong coalition in May’s government is creating more uncertainty, lower levels of economic growth, a possible ‘flight’ from sterling with the associated depreciation of the UK currency and the increased probability of a hard Br As we proceed through the talks, we can start to firm up our expectations of the type of Brexit that is likely to occur. That said, there is little that has been said thus far which would lead me to change any expectation that the UK will experience a ‘hard’ Brexit. The election of a Conservative government supported by the DUP would not cause me to change that expectation.

What I would need to see from a new Conservative government, in order to change my view of the likely outcome of Brexit negotiations, would be a compelling narrative as to why the EU should agree to a soft Brexit. As yet, I do not see why the EU should agree to that. And I am not aware that this compelling narrative exists with May’s Brexit negotiations strategy and if it does exist, has not been shared with the UK voters or the EU negotiators. Yet.

In the meantime, as the survey shows, procurement and supply management teams have made considerable progress in trying to understand the issues and mitigate any possible disruptions as a result of the UK’s exit. As the talks progress, we should continue as before – managing ongoing uncertainty through mitigation strategies and currency hedging opportunities as we await the outcome of the Brexit negotiations.

ABOUT THE SURVEY

These findings were drawn from a survey of over 3,000 supply chain managers from across the globe who were asked for their views and reactions to Brexit. The first survey ran in April and the second in September 2017. The survey included around 1000 UK businesses with European supply chains and European businesses with UK supply chains. The highest number of respondents were in the manufacturing, banking, retail and energy sectors so are represented individually in the report.

It was clear that businesses in the UK and EU were both making preparations and plans to sever supply chains - at least in part.

- 32% of UK businesses who use EU suppliers are looking for British replacements

- Nearly half (46%) of European businesses expect to reduce their use of UK suppliers

- 36% of UK businesses plan to respond to Brexit by beating down supplier prices

- The UK’s “weak negotiating position” is seen as the biggest hurdle in trade talks

- Risk analysis is high priority – 44% are performing a risk analysis exercise

The UK’s “weak negotiating position” is seen as the biggest hurdle in trade talks

Businesses in the UK and EU continue to both make preparations and plans to sever supply chains - at least in part.

- 40% of UK businesses who use EU suppliers are looking for British replacements

- 63% of European businesses expect a bigger portion of their supply chains will be outside UK

- 14% of UK businesses with EU suppliers say part or all operations will cease to exist

- The UK’s “lack of clarity on priorities” is seen as the biggest hurdle in trade talks

- Risk analysis is high priority – 48% are performing a risk analysis exercise

The UK’s “lack of clarity” is the biggest hurdle in trade talks

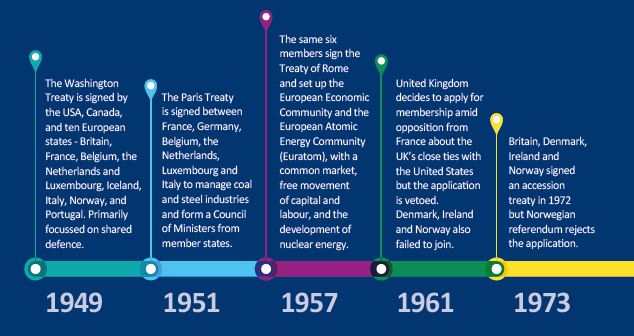

The EU timeline

The Brexit situation

On the 23rd of June 2016, the UK public voted to leave the European Union; a relationship that had lasted for more than 40 years. The vote had a majority of 51.9% to 48.1% who voted to remain. Article 50 of the Lisbon Treaty was invoked by Theresa May, the British Prime Minister, on the 29th of March 2017, beginning the process for formal negotiations to leave.

‘Brexit’ has already had economic and political effects as measured by CIPS Risk Index powered by Dun & Bradstreet, and the Markit/CIPS Purchasing Managers’ Indices (Markit/CIPS PMI®) and will continue to create waves in procurement and the wider business community, around the world. Soon after the result, the CIPS Risk Index (2016 Q3 results) showed global supply chain risk grew for the third consecutive quarter, as the Brexit result raised questions about the future of globalisation and had a negative impact on trade and business in the UK and across Western Europe. The flash Markit/CIPS PMI® in July showed that the UK economy had contracted at the steepest pace since 2009 and that both new orders and output fell for the first time since the end of 2012. Though the PMIs subsequently recovered their strength, the CIPS Risk Index has still registered underlying risk in part because of the continuing uncertainty over global trade and what the new landscape could look like.

The UK Parliament authorised Theresa May to give Article 50 notice and will scrutinise negotiations along the way through debates and select committees. The Repeal Bill (European Union (withdrawal) Bill), translating EU into British law will focus on immigration, agriculture & fisheries and nuclear safety. The Customs Bill will mean more control for the UK and changes to the UK’s VAT and excise process where the Government can collect duties, and challenge evasion. A new trade Bill will include a legal framework so Britain can sign new trade deals with countries and businesses can be protected from unfair trading practices.

Procurement and supply management professionals have a unique and important view, and control over how to mitigate impact on supply chains and build stronger networks. As guardians and suppressors of panic within their own organisations they have a great opportunity to implement not just best practice but sustaining the future of their business.

CIPS wanted to know what measures the procurement community was taking to manage the effects of Brexit. More than 2000 responded around the world. We hope this informs and inspires other buyers and professionals to develop their own plans and activities to manage the effects of Brexit, whatever that means to them. The second survey results will be out later in the year.

UK business: summary of first survey findings from UK supply chain managers with European suppliers

Amongst the UK group, the biggest issue facing UK businesses was currency fluctuation impacting on business (65%), with the expectation that Brexit would impact their companies ‘in due course’ holding the second highest score (34%). In comparison, this leaves the UK significantly behind EU businesses which are already forging ahead with making decisions and contingency plans. Many UK businesses, however, have already started to re-negotiate their contracts with suppliers to either mitigate any cost rises or to ensure surety of supply should there be a break in the supply chain.

Preparing for Brexit, the UK was primarily focussed on risk analyses (43%) and looking for alternative suppliers in the UK (31%), in-shoring supply chains, bringing them closer to home. Collectively, the third highest response should cause the highest level of unease – almost a quarter of respondents (24%) said they hadn’t done any work to prepare. At all.

However, the biggest long-term impact of the vote to leave could be on suppliers. A third of respondents cited that they would push to get suppliers’ costs reduced (36%). According to the Federation of Small Businesses, 99% of all private sector businesses in the UK in 2016 were small or medium-sized suppliers so this cost-focused-only solution will hit them hard when input costs for businesses are high and margins may be squeezed further if inflationary pressures rise.

Not all is lost, though, as almost three quarters (72%) of supply chain managers, felt they had the skills needed to minimise supply chain disruptions caused by the Brexit process. As procurement professionals with a big responsibility for a company’s spend and guardians of their own enterprise, this will be some relief for the organisations they work for.

UK businesses have a message for the UK Government on the eve of the Brexit negotiations has to be keeping tariffs down and quotas on goods and services moving between the UK and Europe to a minimum (39%) and keeping the red tape on goods and services between the UK and Europe low (25%). Otherwise those squeezed margins suppliers are experiencing are likely to get worse.

The free movement of people was also a priority where 16% of respondents highlighted the need to reduce any obstacles between the UK and EU and the same number to retain current regulation around supply chains.

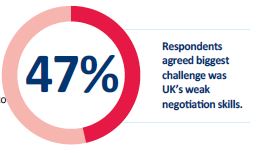

The survey highlighted some major fears from supply chain managers around the UK’s position before the talks even begin and the weakness of that position was the biggest concern for 40% of respondents. The pressure of time was the second at 36%. A lack of negotiating skills (32%) and a dearth of supply chain skills and expertise caused nervousness amongst 33% of respondents. Just over a quarter don’t believe that British negotiators have the necessary business contacts to make Brexit a success (26%). The UK Government aims to develop a “deep and special partnership” with the EU with protected rights for citizens on either side of the European divide, a free trade agreement for goods with few barriers, and co-operation over security and policing. Supply chain managers will be at the forefront of managing these outcomes, mitigating any risks to businesses reliant on supply chains to survive.

Questioned on the impact of international trade deals, two thirds of UK supply chain managers (66%) believed that ongoing uncertainty was making long-term planning difficult, but responses were fairly neutral on whether supply chains were more difficult to maintain. Higher cost pressures were an issue for 63% as inflation threatens to bite and costs of raw materials and goods from outside of the UK continue to rise.

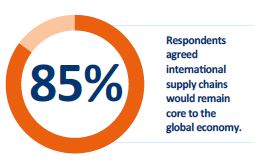

The continuing importance of global supply chains remains high on the agenda as 86% said that at least in the short to medium-term, they will be the crux of the global economy.

What the first Brexit results revealed about individual sectors in the UK

Banking and finance

Currency fluctuations were at the top of the list of issues to affect supply chains with the Brexit vote where 58% said supply chains had become more expensive. Though there had been some noise from companies in the sector looking to move to Europe such as JPMorgan and Standard Chartered, the second highest response showed that 46% believed there had been no immediate impact but expecting there to be change shortly.

When asked how prepared the sector was for the UK leaving the EU, 56% said they were performing a risk analysis exercise and 44% said they were mapping the potential costs of new tariffs. In addition 36% said they were looking for other suppliers in the UK.

When asked what the long-term impacts would be on supply chains, the top answer (36%) was that suppliers would take the brunt of protecting business margins and would have to reduce their prices and intriguingly another 36% said ‘none of the above’ which would need further investigation in the second survey.

Confidence is high as 73% of respondents believed that they have the necessary skills to manage any disruption in their supply chains.

Once again the importance of keeping tariffs and quotas on goods to a minimum between the UK and the EU was the highest concern (38%). The second most important concern was ensuring workers can move freely between the UK and Europe (29%). Maintaining regulations between EU and UK supply chains came third with 17%.

In this sector, a lack of time was the biggest barrier facing negotiators (54%) and a concern that the UK was in a weak negotiating position (50%), with a lack of negotiating skills (25%). The lack of supply chain expertise was high at 29%.

When asked about the impact of international trade deals on respondents’ supply chains, most respondents scored highly around uncertainty making long-term plans difficult (71%), increased difficulty in maintaining long international supply chains (50%), and the increased costs in their supply chains (71%). However the highest scores were assigned to the certainty that international supply chains will still be essential after the Brexit negotiations were completed (79%).

Manufacturing

Currency fluctuations overwhelmingly were the biggest cause of concern for the sector as supply chains become more expensive (75%), contracts being re-negotiated (24%) but over a quarter (29%) not seeing any impact and not expecting any impact to materialise.

In preparation for the split from the EU, the sector said it was mostly performing a risk analysis (40%) but looking for alternative suppliers in the UK was the response from over a third (37%). However, 22% were looking for suppliers outside the European Union and 27% were making efforts to get closer to their EU suppliers (27%). Around a quarter (25%) said they were looking at costs of potential tariffs. Only 11% were already looking to increase their prices, but a worrying 26% said they hadn’t done anything in preparation.

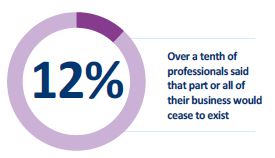

The longer term impact is bad news for suppliers as 43% said input costs would have to be negotiated lower. Around 18% said they would bring some of their operations to the UK but 25% said more of their supply operations would be located outside of the EU. Over a tenth of professionals said that part or all of their business would cease to exist (12%).

Supply chain professionals in the manufacturing sector remained confident (76%) that they have the necessary skills to manage any disruption in their supply chains as a result of the Brexit process.

Overwhelmingly, the biggest issue for the sector during negotiations by the UK Government is keeping potential tariffs minimal (50%). The second highest response was around red tape between the EU and the UK to remain low (21%). Sufficient levels to top up the workforce were of moderate concern at 15% and maintaining regulations was noted by 12% of respondents.

In line with the banking and retail sectors, a lack of time was the sector’s higher concern at 43%. Secondly it was the UK’s weak position to negotiate successfully (39%) causing apprehension. A lack of supply chain skill (31%) and negotiating skills (23%) were also of concern, along with a lack of confidence in the negotiators steering the UK’s towards Brexit (24%) as being deficient in their business contacts. A skills gap was also high on the list of challenges selected by 23% of respondents.

When asked about the impact of international trade deals on respondents’ supply chains, most respondents agreed that uncertainty was making long-term plans difficult (64%), and 56% said supply chains would be more difficult to maintain. A higher proportion agreed that supply chains had become more costly (65%). But the future was bright for global supply chains as 86% said their importance would remain high.

Retail and wholesale

Currency fluctuations overwhelmingly were the biggest cause of concern for the sector as supply chains become more expensive (81%) and re- negotiating contracts with suppliers was next at 46%. Relationships with suppliers had become more strained for 19% of respondents. The remainder of responses all scored 10%:

- Postponed or cancelled contracts because of Brexit uncertainty

- No impact yet, but change expected

- No impact and none expected

When questioned about preparations to leave the EU, a high proportion were performing a risk analysis exercise (65%) and 51% were looking for UK suppliers, which is good news for the country. Next was costings for potential new tariffs (43%) and the fourth most important activity was consolidating relationships with existing EU suppliers (39%). The sector was also looking at mitigating their own potential cost rises by charging their own customers more (22%). Recruiting staff from the UK was a low priority (4%) and 8% had not done anything to prepare.

When asked what the long-term impacts would be on their supply chains, suppliers were at the forefront of having to make changes as 57% of respondents said they would expect suppliers to reduce their prices. An equal number (16%) said they would re-shore their supply chain to the UK and also a greater part of the supply chain would go to suppliers outside the EU. Around 22% of the respondents chose ‘none of the above’ which will be explored further in the second version of the Brexit survey later in the year.

The retail sector displayed high confidence in its skills (76%) that they could manage any difficulties in their supply chains as a result of Brexit.

The sector’s response around the biggest issues facing the negotiators is keeping potential tariffs low (38%) and keeping red tape minimal (34%). The need for workers and free movement was relatively low (11%) and maintaining supply chain regulations (17%).

A lack of time was the biggest concern for retailers (38 %) along with worries about negotiators and their personal contacts (36%) and the UK’s weak position (36%) when dealing with what will be a hard negotiation over a long time.

There was also an issue around the dearth of supply chain knowledge and expertise in the sector (34%) and ensuring the skills gap is improved for negotiators (19%).

When asked about the impact of international trade deals on respondents’ supply chains, most respondents agreed that uncertainty was making long- term plans difficult (80%). Long international supply chains were becoming more difficult to manage according to 59% and wholehearted agreement that they were getting more expensive 80%.

Around 85% of the respondents agreed that international supply chains would remain core to the global economy.

ENergy and utilities

Currency fluctuations by a large margin was the biggest cause for concern in this sector (55%) as supply chains became more expensive, as respondents were asked about the main impact of the UK’s decision to leave the EU. Following as a close second, according to 39% of respondents, there has been no impact so far but there was an expectation there would be one soon. Around 20% have already had to re-negotiate contracts with suppliers, followed by 12% have had to postpone or cancel contracts because of the uncertainty, and another 12% believed they had not experienced any impact and didn’t expect there to be one.

When asked about preparations to leave the EU, the highest proportion at 41% said they were performing a risk analysis exercise. Followed by mapping the potential of new tariffs (35%) and 26% looking for alternative suppliers inside the UK. Almost a quarter (24%) hadn’t done any work at all in preparation.

Any results around long term impacts were inconclusive as the majority of respondents (35%) said ‘none of the above’ which will be explored in the second survey. However, the second most popular response at 22% said that there would be a greater portion of their supply chain will be based outside of the EU.

The sector was relatively confident when it came to possessing the right skills when managing supply chains and minimise disruptions as 71% said they had the right skills.

Much the same as other sectors, the biggest concern amongst procurement and supply chain professionals in the energy sector was keeping tariffs and quotas between the UK and Europe to a minimum (53%), keeping red tape low (26%), and ensuring free movement of people between Europe and the UK at 13%.

The biggest challenges facing UK negotiators according to the energy sector was overwhelmingly the UK’s weak negotiating position (47%), with a lack of negotiating skills at 41%, a lack of time at 37%, and a lack of business contacts at 33%. A skills gap came in at 31% and a lack of supply chain expertise came in at 27%.

Almost 59% believed that uncertainty around international trade agreements was making long term plans more difficult and 38% thought that long international supply chains were becoming more difficult to maintain. And 62% believed that supply chains were becoming more expensive but that the long-term importance of international supply chains was assured as 85% believed they would still be a large part of a global economy.

The situation in Europe: summary of first survey findings from European supply chain managers

In stark contrast to the UK, EU businesses’ biggest response to the question about the UK’s EU departure was the expectation that there will be an impact in due course, but there was little so far (61%). Currency fluctuations affected 17% of respondents, and 15% didn’t expect any impact at all. Only 12% experienced postponed or cancelled contracts. But some re-negotiation did happen amongst 9% of those surveyed.

The most startling result was that 44% of businesses were looking for suppliers outside of the UK and a confident 46% said that a greater portion of their supply chain will be based outside of the UK in the long term – added pressure for UK negotiators. Over a quarter of EU supply chain managers have not done any preparation work at all (28%) and almost 27% were already mapping the potential costs of new tariffs. Some forward-thinking managers were making efforts to strengthen existing relationships with UK suppliers (12%).

26% said they would re-shore all or part of their supply chain outside Europe and there was more challenging news for suppliers as almost 21% of respondents were pushing supplier costs lower.

Confidence in their own supply chain management abilities were high as 75% thought they had the knowledge and skills needed to steer their business through the Brexit process.

However, respondents were divided on what the most important aspect for consideration should be amongst the UK’s negotiators working on a new trade agreement:

- 28% favoured keeping tariffs and quotas to a minimum

- 26% favoured maintaining consistency in supply chain regulation between the EU and UK

- 23% favoured keeping administrative procedures minimal

- 19% said ensuring workers can move freely between the UK and Europe was a priority

What the Rest of the World thinks: summary of first survey findings from supply chain managers outside Europe

When asked about the effect of the Brexit decision on supply chains outside Europe, the response was the same as the EU businesses. Little impact immediately (52%) but an expectation there would be some further down the negotiation road, but without any clear indication of what that could be.

The second most noted impact (25%) was currency fluctuations where working with UK businesses had become more expensive though many businesses have also found the UK cheaper because of the weak pound resulting in more export orders to UK businesses.

The most striking aspect of the views of businesses outside the UK is the split between those respondents who were performing a risk analysis (34%) and those that had not prepared anything (33%) and mapping out the potential costs of new tariffs (25%). Tariffs and the subsequent impact on global business are the single most concerning issue to these businesses. Around 23% expected no impact.

There was good news for suppliers who managed to retain their current relationships with businesses outside of the UK, with the majority of survey respondents stating that relationships hadn’t changed since the vote (73%). Though the percentage of those experiencing uncertainty was worryingly high at 21%. A small percentage (7%) said their supplier relationships had become more strained. The next survey towards the end of the year will clarify if any difficulties during the negotiations process increase that level of ambiguity.

Once again, optimism and confidence was high relating to the skills required to manage the ebb and flow of disruptions to supply chains. Almost three quarters of businesses outside the EU believed they had the skills necessary to do the job (74%).

Uncertainty around international trade deals overall reflected the UK’s and EU’s experience along the path to Brexit, where 71% felt unsure how they would pan out and the overall successes the changes would have. Just over half believed that international supply chains were more difficult to manage (54%) and said they were more expensive (50%). However very few were in doubt that international supply chain would NOT be a feature of global business in the future (90%).

Views from the global procurement and supply management community

Matt Roper, CEO of the consultancy Buying Support Agency, said: “Buyers dealing with EU-based suppliers can turn negative into positive by engaging fully with them to both reassure and protect the supply chains.

“Conversely, even if relationships with EU suppliers sour, buyers may be unaware of some highly innovative and value-add supply chains in the rest of the world, including the UK itself. Positive consequences may result in switching to non-EU suppliers, but only if buyers can develop the alternative supply strategies.”

Dale Turner, director of procurement and supply chain at Skanska UK, says his company has put a greater focus on relationship management and planning ahead. “We’ve been collaborating early with our strategic supply chain – including a key knowledge share on market conditions. Two years ahead of tenders landing, we are aligning our supply chain so resources can be prioritised to deal with major pinch points. We are consolidating the supply chain for key commodities and hedging and forward-buying where appropriate. And we are looking at a wider pool of providers – flexible and agile to adapt to changing requirements.”

Ric Traynor, executive chairman of Begbies Traynor, said: “Rising energy and food prices, combined with the devaluation of sterling, have undoubtedly put a strain on the much of the UK’s supply chain.

“As we wait to see what a future UK trade agreement with Europe might look like, these suppliers face continued uncertainty, not just in terms of their European distribution channels but also with regards to staffing, given their higher reliance on European migrant workers.”

Richard Jesson, CPO at Aston Martin Lagonda, advises buyers: “Keep calm. Reduce risk and seek to understand where you are going to be in the next year.”

Duncan Brock, Group Director of Customer Relationships, CIPS, commented: “Diplomats either side of the table have barely decided on their negotiating principles, but supply chain managers are already deep into their preparations for Brexit. Both European and British businesses will be ready to reroute their supply chains in 2019 if trade negotiations fail and are not wasting time waiting to see what happens.

“Fluctuations in the exchange rate or the introductions of new tariffs can dramatically change where British companies do business. The separation of the UK from Europe is already well underway even before formal negotiations have begun.

“We have already seen high profile disputes between British retailers and their suppliers as a result of currency fluctuations. We now know that this pattern is being replicated across the UK and is likely to escalate.

“The reshoring of British supply chains in advance of Brexit could provide an excellent opportunity for small businesses looking to win new contracts, but it also comes with significant challenges. Brexit is likely to bring considerable costs for businesses in the UK and Europe; these costs are then going to be passed on to small suppliers and eventually consumers.”

What should procurement professionals do?

As guardians of international trade, supply chain managers can protect the businesses they work for by leading the CEO and the board towards best practice, risk mitigation and strengthening the supply chains they are reliant on.

It is also a great opportunity for professionals to show the true value of their profession and good procurement practice.

- Audit your supply chain from end to end

Understand what you spend, who your suppliers are and build strong relationships with them in order to be agile and flexible. - Reassure and reassure again

Customers, suppliers, partners, staff and your CEO are going to get nervous. The deal is still going to take just under two years to negotiate, so for now it’s business as usual. However, there are things you can do to prepare. Looking at length of contracts, and the implementation of break clauses or perhaps currency hedging and multi-sourcing could help your business to prepare. - Work together

Build cross-functional teams to monitor the situation, include risk management colleagues, compliance, financial, legal, operational, sales and marketing teams. - Prioritise

Understand and prioritise the likelihood of any risk impact and have a clear understanding of what this could be, who will be affected, why and where the impact with happen. - Review contracts

Don’t just look at contracts, also look at any deals on the horizon. - Research issues

Research issues that affect your sector, business of your size and continue to monitor as the situation evolves and changes. - Communication

Develop a list of credible sources and arm yourself with data and timely, regular information. Keep stakeholders regularly informed, remaining clear and transparent about the implications.

Gerry Walsh, Group CEO, CIPS

As a global organisation, CIPS is supportive of free trade and, with a community of 115,000 spread around the world, procurement can have an impact on the economic, social and environmental agenda. CIPS believes that procurement and supply management professionals have a key part to play when supporting their business though the Brexit process which is likely to hit every sector in the UK, and possibly around the world.

Therefore, this survey is key in understanding the thinking as well as the actions of procurement professionals across a range of different countries and sectors, along with how these perspectives compare. This information will hopefully help supply chain managers to decide on the best course of action for them.

It is clear that, although diplomats on either side of the table have barely decided on their negotiating principles as the Brexit talks begin, supply chain managers are deep into their preparations for the UK’s exit. Both European and British businesses will be ready to re-route their supply chains in 2019 if trade negotiations fail and are not wasting time waiting to see what happens.

Fluctuations in the exchange rate or the introduction of new tariffs can dramatically change where British companies do business. This, along with uncertainty around the outcome, has prompted businesses to take pre-emptive action, meaning the separation of the UK from Europe is already well underway even before formal negotiations have progressed in any significant way.

We have already seen high profile disputes between British retailers and their suppliers as a result of currency fluctuations. We now know that this pattern is being replicated across the UK and is likely to escalate.

The reshoring of British supply chains in advance of Brexit could provide an excellent opportunity for small businesses looking to win new contracts, but it also comes with significant challenges. Brexit is likely to bring considerable costs for businesses in the UK and Europe; these costs are then going to be passed on to small suppliers and eventually consumers.

I would urge you to delve deep into the survey results and see how it impacts on the sector you are in and how you can understand this brave new dawn for your own supply chains and how you can mitigate against possible disruption.

We will be running the survey approximately every 6 months to see how the picture changes, so I would also urge you to participate and offer your own views when the next survey comes out.

About CIPS

CIPS, is the world’s largest organisation dedicated to the profession. We are the voice of procurement and supply across the globe.

CIPS works for the good of the profession and the public by continually driving improvements in supply chain practice.

CIPS champions the raising of standards in the profession through:

- Professional qualifications, culminating in MCIPS membership and Chartered Status

- Leading-edge thinking and research through the CIPS Knowledge area of our website

- Actively lobbying world governments and driving the professional agenda at every level including the boardroom.

Licensing the Profession

CIPS has called for Licensing the Profession to raise the status of procurement and supply, recognise individual excellence and engender public confidence and is supported in this aim by the United Nations Development Programme.

MCIPS is the Licence for the Profession

Recognising a higher level of understanding and ability.

Global Standard

CIPS has established the Global Standard for procurement and supply, which is free to all and identifies current operating levels of skills, abilities and capability gaps.

Ethical Procurement

CIPS champions the ethical procurement agenda, which includes driving out corruption and modern slavery, and builds greater confidence in the profession by:

- Licensing procurement and supply professionals

- Bringing attention to, educating and affecting behavioural change in individuals and organisations

- Holding our global membership to account through our Code of Conduct, Ethics Test and Chartered Status.

Working with governments, humanitarian world organisations and industry to raise awareness of sustainable procurement practices and legislation, and drive out corruption and modern slavery in supply chains.

“CIPS supports governments to use public funds wisely, deliver better services within budget constraints, support their national economies and build public sector reputation.” Babs Omotowa, CEO Nigeria LM

Next CIPS Brexit survey results – launching later in the year

To monitor the changing landscape on the path to Brexit, CIPS will be conducting regular surveys to see how confidence changes, whether procurement and supply chain professionals take significantly different actions towards the end of the negotiations than at the beginning, and what impacts these will have in the UK and beyond.

Survey methodology

UK supply chain managers with European suppliers

It was the private sector that had the biggest voice in the survey (69%), but a broad range of sectors participated, mostly from larger corporates of 250 employees or more (77%).

Responses were received from South East (18%); London (17.4%); South West (11.5%); North West (9.8%); West Midlands (9.3%); Scotland (8.2%) and smaller percentages for the rest of the UK. The manufacturing industry featured largely (30.7%) plus retail (8.8%), energy (8.2%) and banking (4.2%) which are all featured in more detail in the report.

European supply chain managers with UK suppliers

Western Europe was the most vocal in the number of responses (48%) and the results were mostly from the private sector (68.%). Manufacturing and engineering were highly-featured (around 23%) and were most represented. With energy and utilities second (17%) and in third Fast Moving Consumer Goods (FMCG) at 7.6%.

As in the UK results, European supply chain professionals from large corporations were the highest number of respondents as 84%, representing companies with 250 or more employees

Supply chain managers outside Europe with UK suppliers

The South Africa and Sub-Saharan region provided the richest seam of evaluation (40%) of the Brexit situation with the highest number of respondents, mostly from the private sector with a focus on doing business with the public sector. Most of the respondents operated in the energy and utilities sector (25%). Again, larger corporates of 250 plus employees dominated.

Sector Focus (UK only)

Respondents could choose more than one option in all the questions so the combined scores would not add up to 100%.

Banking and finance

This sector had a high proportion of international suppliers, including European suppliers at 81%. A high proportion of respondents were located in London (34.4%), with the second highest located in Scotland (18.8%). The highest number of respondents came from large corporates of 250 employees or more (93.8%).

Manufacturing

The number of survey respondents were relatively equally split between the regions, with 17.5% from the South East, 14.5% from the East Midlands, 16% from the West Midlands, 10.5% from the East of England, and 10% from the North West. All of the respondents were from the private sector, and the larger proportion came from larger businesses (66.8%), with 8% small business and 25.1% from mid-sized organisations. The larger section of respondents (94%) have international supply chains with some European suppliers with only 3% with UK –only suppliers and 3% with an international supply chain without European suppliers.

Retail and wholesale

Most of the respondents came from the South East area (30.4%), followed by London (21.4%), East Midlands (12.5%), West Midlands (10.7%), North West (5.4%), Yorkshire and Humber (5.4%) and then smaller percentages for the rest of the UK. 100% of the respondents were from the private sector, and the larger proportion came from larger businesses (62.5%), with 12.5% small business and 25% from mid-sized organisations. The larger section of respondents (96.4%) have international supply chains with some European suppliers and 1.8% with an international supply chain without European suppliers, and 1.8% UK-only supply chains.

Energy and utilities

Most of the respondents came from Scotland (21.7%) where there is a high number of energy, oil and gas industries. The second highest number of respondents came from London (15%) then North West (13.3%), South East (11.7%), South East and North East both at 8.3% then West Midlands at 6.7%. 100% of the respondents were from the private sector, and the larger proportion came from larger businesses (80%) with mid-market at 11.7% and SMEs 8.3%. The larger section of respondents (83.3%) have international supply chains with some European suppliers and 1.7% with an international supply chain without European suppliers and 15% UK-only supply chains.

Related pages

Content related to: The Brexit storm

On this page

- Summary of the first CIPS Brexit

- Summary of the second CIPS Brexit survey

- The EU timeline

- The Brexit situation

- UK business: summary of first survey findings

- What the first Brexit results revealed about individual sectors in the UK

- What the Rest of the World thinks

- Views from the global procurement and supply management community

- What should procurement professionals do?

- About CIPS

- Survey methodology